Syair sdy – Data Sdy. Pembahasan kali ini sedikit berbeda sebab kami menghadirkan 2 topik besar pada kesempatan kali ini. Data sdy 2022 Akan menjadi acuan pengeluaran togel sydney yang di ambil dari web aslinya. Syair sdy 27 april 2024.

data sydney pools

Contents

Data Pengeluaran sdy hari ini

| DATA KELUARAN SDY TAHUN INI | |||

|---|---|---|---|

| No | Tanggal | Hari | Result |

| 1 | 26 April 2024 | Jumat | 9424 - SDY |

| 2 | 25 April 2024 | Kamis | 3807 - SDY |

| 3 | 24 April 2024 | Rabu | 7854 - SDY |

| 4 | 23 April 2024 | Selasa | 5401 - SDY |

| 5 | 22 April 2024 | Senin | 9058 - SDY |

| 6 | 21 April 2024 | Minggu | 6075 - SDY |

| 7 | 20 April 2024 | Sabtu | 3622 - SDY |

| 8 | 19 April 2024 | Jumat | 2109 - SDY |

| 9 | 18 April 2024 | Kamis | 2172 - SDY |

| 10 | 17 April 2024 | Rabu | 6197 - SDY |

| 11 | 16 April 2024 | Selasa | 6290 - SDY |

| 12 | 15 April 2024 | Senin | 2773 - SDY |

| 13 | 14 April 2024 | Minggu | 5139 - SDY |

| 14 | 13 April 2024 | Sabtu | 1837 - SDY |

| 15 | 12 April 2024 | Jumat | 0547 - SDY |

| 16 | 11 April 2024 | Kamis | 9396 - SDY |

| 17 | 10 April 2024 | Rabu | 4474 - SDY |

| 18 | 09 April 2024 | Selasa | 1230 - SDY |

| 19 | 08 April 2024 | Senin | 8014 - SDY |

| 20 | 07 April 2024 | Minggu | 0867 - SDY |

Keluaran sydney hari ini di perbaharui tepat jam 14.00 wib.

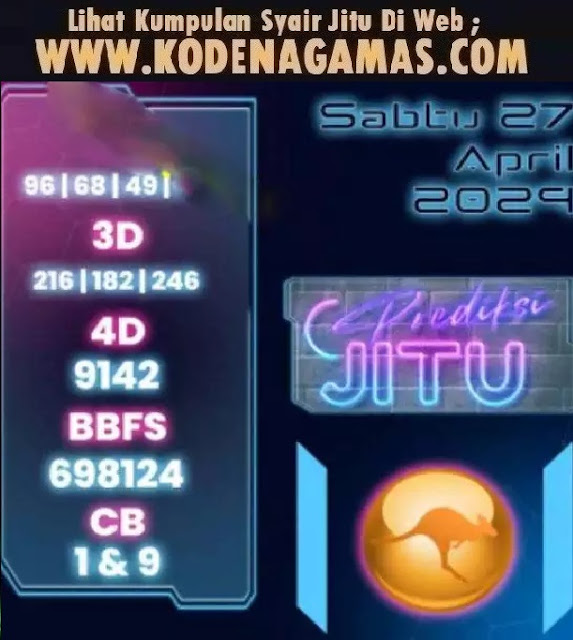

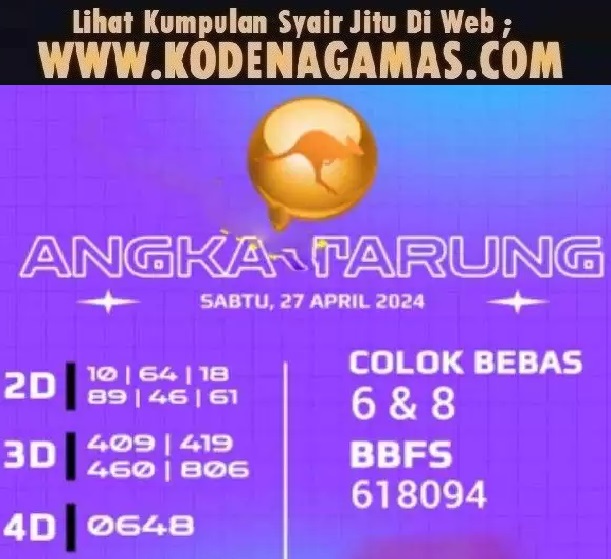

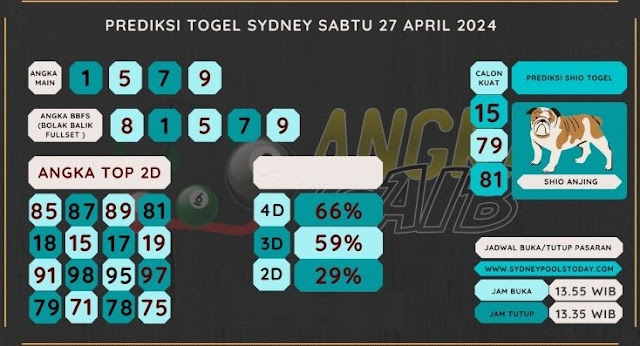

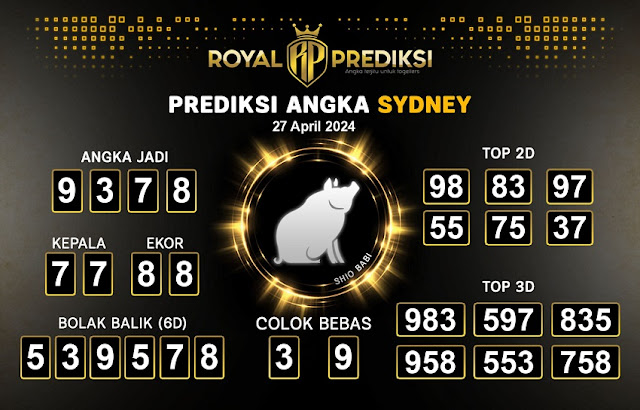

Berapa angka jitu sdy dari syair hari ini 27 april 2024

Dengan adanya 2 topik penting tentang pasaran sydney, Kami berharap para pembaca dapat menikmati hasil kreasi dari kami. Oleh karena itu kami ingin anda semua memberikan komentar positif pada kolom komentar di bagian bawah. Selanjutnya agar kami tahu peminat web syair atau web data seberapa banyak yang menyukainya.

Forum syair sydney harian terlengkap

Mengapa kami berikan juga syair sydney? di sebabkan karena syair menjadi pemicu utama menemukan angka jitu nya. Maka dengan ada nya syair sekiranya dapat membantu sedikit mengetahui angka bagus nya.

Apakah pengeluaran bisa di percaya

Sangat bisa, di karenakan yang melakukan perubaha adalah saya sendiri. tidak melalui bot apapun. Untuk itu simpan alamat web kami. Harapan kami sebagai pemilik web keluaran adalah anda puas dengan buatan kami.